Deciphering Private Equity: A Comprehensive Overview

Unveiling the Basics: What Exactly is a Private Equity Firm?

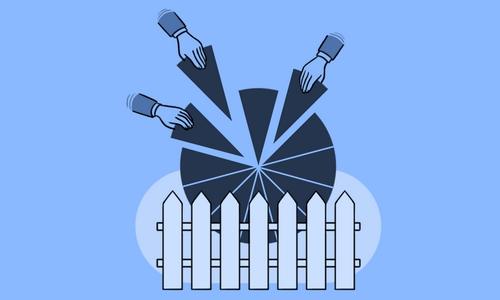

A private equity firm is a strategic player in the world of finance. Essentially, it's an investment management company that pools funds from various investors to acquire ownership stakes in businesses. These firms specialize in injecting capital into companies, often with the aim of driving growth, enhancing operations, and ultimately increasing their value. By actively participating in the management and strategic decisions of these companies, private equity firm contribute to shaping their direction and unlocking potential. This hands-on approach sets them apart in the realm of investment and business transformation.

The Role of Private Equity in the Investment Landscape

Private equity plays a pivotal role in the investment landscape, shaping businesses and fostering growth. These firms, fueled by capital from investors, acquire or invest in companies with potential for improvement. They bring expertise, operational insights, and strategic direction to enhance value. Through active management and tailored strategies, private equity firm can rejuvenate struggling businesses, accelerate expansion for thriving ones, and ultimately contribute to the evolution of industries. Their hands-on approach distinguishes them as influential change agents in the world of investments.